Bitcoin (BTC), the leading cryptocurrency by market capitalization, has reached a new milestone by breaking the $30,000 mark for the first time since April 2023. This comes after a prolonged period of consolidation and volatility that saw the price fluctuate between $20,000 and $29,000 for several weeks.

The rally was sparked by a combination of factors, including positive news from institutional investors, regulatory developments, and growing adoption by mainstream companies and platforms.

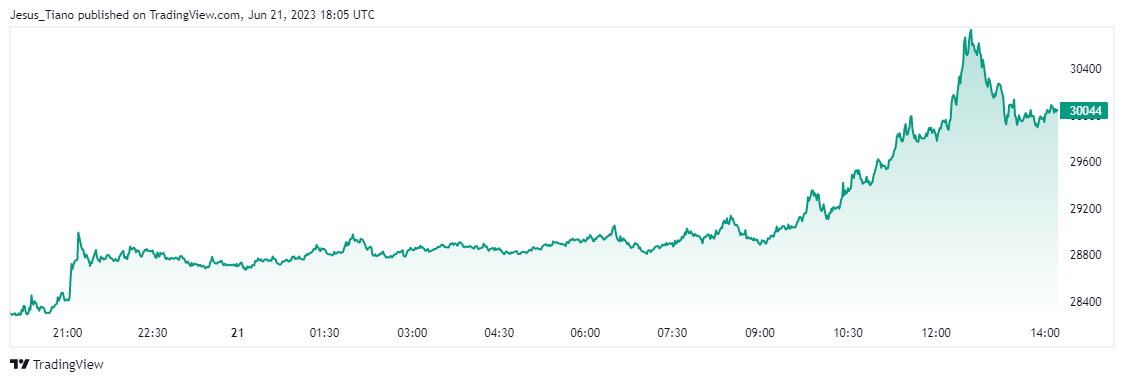

Bitcoin surpasses $30,000 for the second time this year thanks to market optimism following the entry of several traditional financial players (TradFi) into the crypto sector. The cryptocurrency is up more than 10% in the last 24 hours. The last time BTC broke above $30,000 was in April 2023, according to data from TradingView.

Multiple Factors Have Influenced the Recent Bitcoin Peak

The recent surge in Bitcoin Network activity, which rose from 385,000 transactions on June 14 to 435,000 on June 20 according to The Block data, coincided with BlackRock’s filing for a spot bitcoin ETF. An ETF would track the price of actual Bitcoins and allow investors to gain exposure to the cryptocurrency without owning it directly.

“It looks like the crypto market is going to be completely restructured in the country by the biggest investment firms in the near future,” Ruslan Lienkha, head of markets at crypto and fiat service provider Web3 YouHodler, wrote in an email to several news outlets. “More investors will have access to crypto investments with much lower risk. It is important to note that a very small percentage of BlackRock or Fidelity clients interested in spot bitcoin ETFs is enough to move the price further north.”

The surge in the value of the digital currency is linked to the recent filings of several conventional financial firms for exchange-traded funds (ETFs) that track the price of BTC. In addition, a new crypto exchange platform, EDX, which is supported by some major players in the traditional finance sector, also went live on Tuesday.

The exchange is backed by Fidelity Digital Assets, Charles Schwab, and Citadel Securities and will offer four tokens in the United States, including Bitcoin, Ether, Bitcoin Cash, and Litecoin.

Bitcoin cash (BHC) has also spiked on the news, gaining 25% on the day. Other developments include the announcement on Tuesday by banking giant Deutsche Bank that it had applied for a custody license for digital assets in Germany. Despite the SEC’s increased regulation of crypto exchanges, TradFi players remain undaunted.