Optimism has made the decision to sell almost 116 million OP tokens, accounting for almost $160 million. These tokens would be sold to seven private buyebrs, mainly for treasury management purposes.

However, the recent announcement was subject to a mixed response from the masses. Some feared that the sale would result in depressed prices from Optimism dumping most of its tokens in the market. At the same time, others believe that the sale of tokens would not have any impact on the price of Optimism’s native token, Optimism(OP).

Starting today, there will be several transactions totaling approximately 116M OP tokens. We’re sharing as a heads up to our community that these are planned transactions.

— Optimism (✨🔴_🔴✨) (@optimismFND) September 20, 2023

Optimism continued to explain that the tokens to be sold would be sourced from the unallocated portion of the OP token treasury, which suggests that these are not part of the current circulating supply. It was also clarified that these OP tokens would be subject to a two-year lockup period which means that buyers would be unable to sell them in secondary markets. However, the buyers were granted the opportunity and permission to delegate these OP tokens to unaffiliated third parties, mainly for governance-related purposes.

Optimism Stays True to its Plans

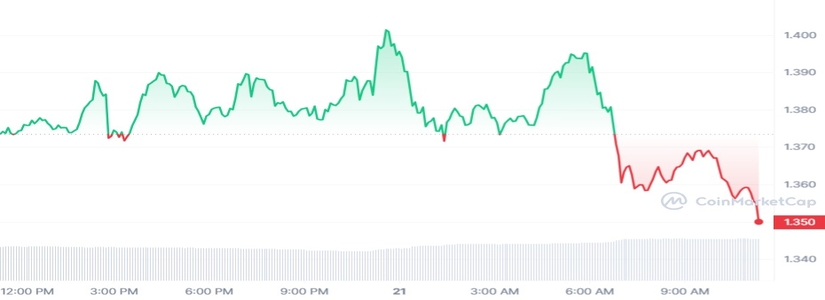

The announcement of selling 116 million OP tokens has adversely affected the trading price of the token as it was seen to be trading in the red. At the time of writing, the OP token has dipped by almost 1.45%, therefore pushing the trading price down to $1.35. The total market cap of the OP token currently stands at the $1 billion mark.

After the announcement regarding the sale of its tokens, Optimism explained that the sale is part of its initial plan and is completely accounted for in its original working budget of 30% of the initial token supply. The sale of OP tokens comes just three days after the announcement of the protocol’s third airdrop. In the airdrop, approximately 19.4 million OP tokens were handed out to more than 31,000 addresses who took part in certain delegation activities.

Optimism, along with Polygon and Arbitrum are some of the most widely used layer 2 scaling solutions in the crypto ecosystem. Despite staying a few footsteps behind Arbitrum generally, Optimism’s overall transactions recently mirrored those of Arbitrum as a result of the surge in user activity on Coinbase’s sandbox along with Worldcoin’s identity verification project.