Galaxy Research recently released a report that stated that about $30 billion was invested in crypto and Web3 startups in 2022.

Despite high-profile meltdowns and the FUD tsunami (fear, uncertainty, and doubt) that followed, the crypto venture capital world had a successful last year. Crypto researchers warn, however, that the funds may not be flowing as easily as they used to this year.

What’s The Reason?

According to the report, venture capitalists were investing more than $30 billion into crypto and blockchain startups in 2022, nearly matching the $31 billion in investments made in 2021. There were some significant investment declines in Q3 and Q4 as a result of macro and crypto market conditions, with the last quarter seeing the lowest deal count and capital invested in the past two years.

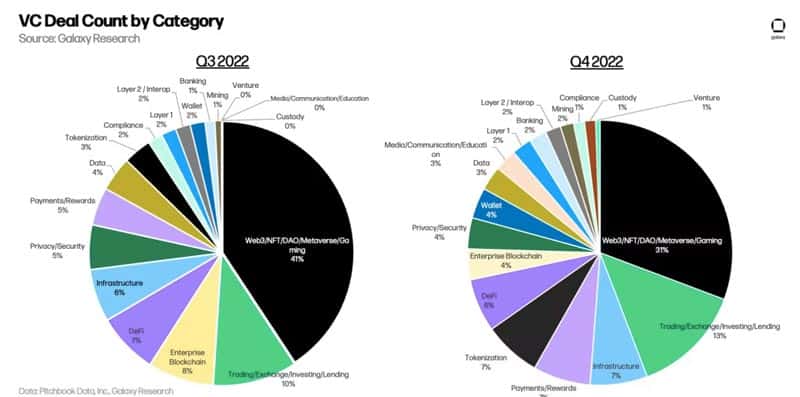

There has been an increase in capital commitments and deals made to later-stage companies over the last couple of years, whereas pre-seed deals have continued to decline. The Web3 category again generated the most deals, but it wasn’t until the companies’ building tools and platforms for Trading and Investment that raised the most money that the Web3 category accounted for the most deals.

Crypto-focused venture firms themselves have been reported to have raised the least amount of capital since Q1 2021, yet they raised over $33 billion in 2022, the most raised by the firms in the last decade.

After hitting an all-time high in Q1 2022, when nearly $13 billion was invested and almost 1100 deals were being signed, the report says deal counts and capital investments have declined every quarter since then.

A decrease in investor risk appetite in the crypto sector has been attributed to rising interest rates, deteriorating macroeconomic conditions, and turmoil in the asset markets. In the last quarter of 2018, more money was invested in crypto startups than it was in the last quarter of 2022.

In terms of investment sectors, Web3 continued to dominate the deal count in Q4 2022 as reflected in its deal count dominance. The largest subsector within the startup sector, Web3, constituted 31% of all deals completed in Q4 2022. It is worth mentioning that the subsector of trading held the second position with 13% of deals.

The conclusion of the report is based on the argument that the crypto VC environment has become increasingly difficult for entrepreneurs and investors alike. There is a decline in valuations because of this tightening as well as stricter investor requirements, which together make raising investment capital for entrepreneurs more challenging.

A startup company must focus on such fundamentals as reducing operational expenses, driving revenue, and taming operational expenses in order to thrive in 2023.