Solana has shocked investors and traders with an unexpected rise in the middle of the week. The coin has rubbished the predictions of a huge decline due to the massive liquidation by the bankrupt crypto exchange, FTX. In a recent development, the US Court has allowed FTX to liquidate its crypto holdings. Moreover, Solana (SOL) tops the crypto portfolio of the exchange.

As per details from the recent filings, the FTX exchange is all set to liquidate a total asset pool of $3.4 billion. The holdings include Solana (SOL), Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Wrapped Bitcoin (WBTC), and Aptos (APT).

Since the bankruptcy of FTX Exchange, SOL has been at the receiving end of price degradation. Back in November the coin even dropped to a low of $8 due to these reasons. However, this time around the coin has shown some resistance towards the speculations. Moreover, FTX has reportedly shown no interest in dumping its SOL holdings at once. It is believed that the exchange will go make a structured plan to sell $100 million in SOL every week. The limit could be raised to $200 million.

FTX gets approval to sell $3.4B in #Crypto assets & CPI data comes in worse than expected

Markets aren't falling down that much, and not much should be happening from it.

The Solana, which corresponds to $1.2 billion of the assets of FTX, is mostly staked and can't be sold.👇… pic.twitter.com/uKG9XefCzy

— Michaël van de Poppe (@CryptoMichNL) September 13, 2023

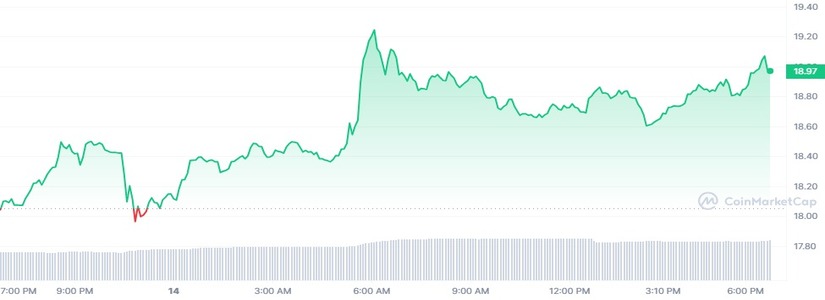

Solana (SOL) Reached the $19 Mark

With an impressive increase of 5%, SOL has quickly approached the $19 mark. The coin is currently trading at $18.97 and has a market cap of over $7.77 billion. This price increase suggests an uptrend for the token. However, it has to maintain a position of over $17.5 to avoid a move to the lower side.

As per details, FTX has around $1.2 million in Solana (SOL). Therefore, any movement of these funds will have a strong impact on the market. It was further reported that the exchange has appointed Galaxy Holdings to conduct a gradual liquidation process for the coins. The exchange is in dire need of funds to settle its liabilities.

On the other hand, the founder of Tron, Justin Sun has urged the crypto community to join hands and reduce the selling impact of FTX holdings. Despite that, the community has kept an eye on the movement of funds held by the exchange. It is yet to be seen how the latest decision helps the FTX exchange in its bankruptcy proceedings and how it impacts the performance of the overall crypto market.