Solana (SOL) has made significant gains over the last day, witnessing an increase of 5%, and it is still going strong. The crypto market has seen a return of positive sentiment in the last few days. It is one of the main catalysts for the sudden increase in the trading price of Solana (SOL). At the same time, the main reason for the surge is linked to the anticipation around the Saga Android phone by Solana (SOL).

Everyone has a story. What will yours be?

Start your Saga on 4.13.2023Solana Mobile Saga Launch Event

Thursday, 4.13.2023, 10am Pacific TimeStay tuned for live streaming info#SagaSZN pic.twitter.com/GJbTtfBumO

— Solana Mobile 🌱1️⃣3️⃣ (@solanamobile) March 23, 2023

Currently, SOL has outperformed a number of other cryptocurrencies in the already positively flowing market. The Saga phone was unveiled by Solana (SOL) last year and is all set for official launch on April 13. The phone would enable users to mint their NFTs from anywhere. Similarly, its use would be as easy as riding a bike for users to access the Solana ecosystem of apps from anywhere and at any time.

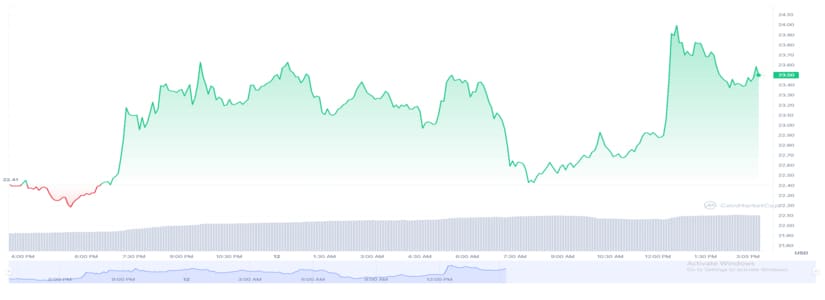

As the launch of Saga comes closer, investors are inclined toward Solana. At the time of writing, SOL has surged by 4.45% in the previous 24 hours, pushing the trading price up to approximately $23.50. The total market cap of the token is almost $9.2 billion. The past week turned out to be in SOL’s favor as the token witnessed a weekly increase of around 11%. After the recent increase, Solana (SOL) managed to reach its highest point since March, when the trading price was almost $23.99.

The Temporary Revival of Solana (SOL)?

Despite the token enjoying decent gains, hardware-related improvements cannot be termed as a decisive element for SOL’s price trajectory. As long as the network fundamentals are concerned, they have remained pretty much the same with no visible improvements. Launches, like the Saga Phone, are good for temporary price boosts but in the long run, they would not impact the price.

The overall NFT trading volumes were subject to a considerable decline on the Solana (SOL) network as well. Thus, the volume dropped from approximately 2 million SOL in January to 1 million SOL, in a span of merely 30 days. Plus, the decline signifies a reduction of approximately $10 million within the timeframe. Thus, the next few days are critical to determining the long-term price pattern of SOL.